Hong Kong Taxation-Salaries Tax

Hong Kong salaries tax is charged on income arising in or derived from Hong Kong as per regional source.

Assessment Period

From 1 April of one year to 31 March of the next year

Deductions and Allowances

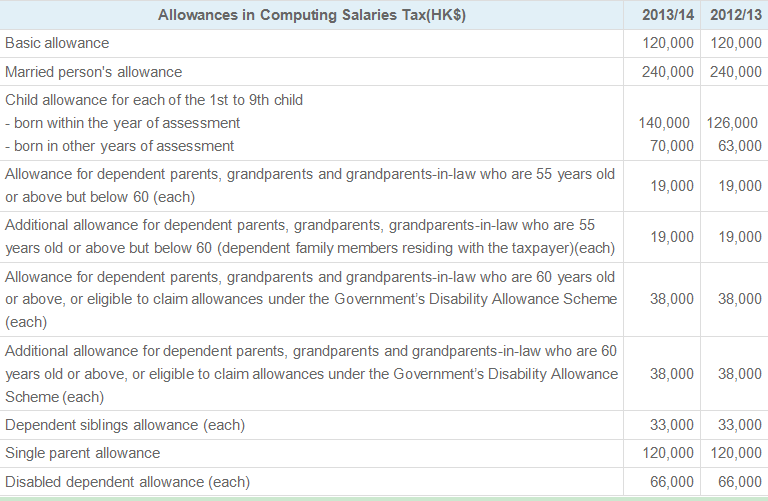

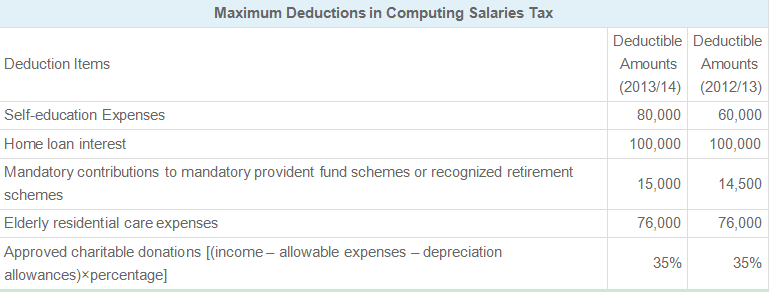

Salaries tax clearly defines deductible items, that deductible portion includes donations from governmentally approved charitable organisations, contributions paid to recognized retirement schemes, self-education expenses, interest on personal home loans and all outgoing expenses incurred in order to fully or necessarily produce the assessable income. The information for tax allowances and tax rates for the year 2012/13 and 2013/14 is listed below:

Rate of Taxation

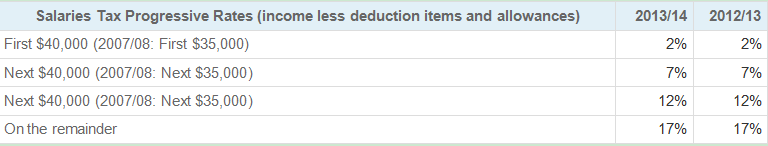

Rate of Taxation Salaries tax is chargeable at progressive rates or standard rate, which will be the smaller of the following:

1) 15% of net total income chargeable at standard rate

2) Net chargeable income at salaries tax progressive rates

Provisional Salaries Tax

Before the related tax year ends, the Inland Revenue Department (IRD) will impose the provisional salaries tax on persons according to the tax payment assessed in the previous year. In the succeeding year, when the tax payment for the related year is assessed, the provisional tax paid will be used to pay the salaries tax payable in that year.

Follow WeChat

Follow WeChat